Submitted by Alan Kelly on Friday 8th December 2023

Published on Friday 5th January 2024

Current status: Closed

Closed: Wednesday 29th May 2024

Signatures: 306

Relevant Departments

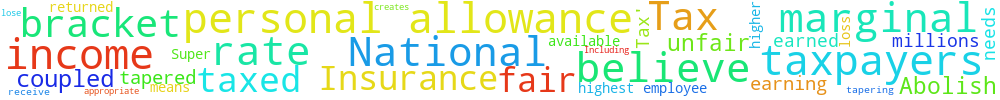

Abolish personal allowance tapering

The highest marginal tax rate on income is 62% (Including the employee’s National Insurance) on taxpayers between £100,000 and £125,140. We believe it is unfair that these taxpayers have a higher marginal rate than those earning millions. The personal allowance needs to be returned to everyone.

For every £2 earned over £100,000, taxpayers lose £1 from their personal allowance (which is then taxed at the 40% rate). This means that all taxpayers with an income over £125,140 do not receive the personal allowance.

This bracket of income is taxed at 42% (40% Income Tax and 2% National Insurance). This coupled with the tapered loss of personal allowance creates the 62% 'Super Tax' bracket.

We believe this is not appropriate or fair and the personal allowance should be available for everyone.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

18.118.144.98 Sat, 23 Nov 2024 14:47:14 +0000