Submitted on Wednesday 18th February 2015

Published on Friday 20th February 2015

Current status: Closed

Closed: Monday 30th March 2015

Signatures: 151

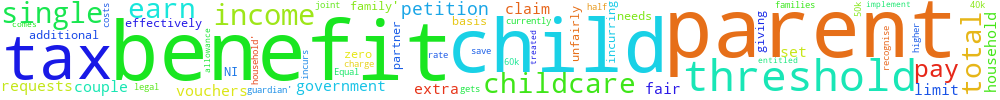

Equal benefit threshold for single parent families

The government needs to recognise that single parents who pay higher rate tax are being treated unfairly when it comes to the income threshold for child benefit and the allowance for childcare vouchers.

The income threshold for child benefit is currently £50k for either partner. On this basis both parents could earn £49,999 each, giving a total joint income of £99,998 and they would be entitled to claim full child benefit. A single parent could earn £60k and effectively get zero child benefit after incurring a tax charge. How is it fair that a couple can earn an extra £40k? This petition requests that the government implement a 'household' or 'total legal parent/guardian' income threshold.

Childcare vouchers have a limit per parent, so a couple can save additional tax and NI over a single parent who pays the same tax and incurs the same childcare costs but only gets half of the benefit. This petition requests that the limits are set 'per household/family'.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

18.220.136.165 Sun, 28 Apr 2024 05:41:17 +0100