Submitted on Sunday 22nd March 2015

Published on Thursday 26th March 2015

Current status: Closed

Closed: Monday 30th March 2015

Signatures: 1

Tagged with

HMRC RTI PAYE earlier year updates

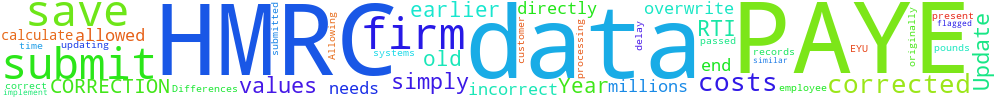

At the present time, when a firm needs to submit corrected PAYE data for an employee, they must calculate the Differences between the originally submitted PAYE data, and the Corrected values, before they submit an Earlier Year Update to the HMRC.

Before 2004/05, they were allowed simply to re-submit the whole correct values, flagged as a CORRECTION to directly overwrite the old incorrect PAYE data.

Allowing firms to do this once more with PAYE RTI EYU data will save the HMRC many millions of pounds in processing costs, and save firms a similar amount of costs.

It costs nothing to implement, and will save delay in updating customer's records, as the corrected data can simply be passed through to HMRC back end systems.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

18.223.106.114 Fri, 26 Apr 2024 03:21:41 +0100