Submitted on Sunday 13th December 2015

Published on Wednesday 16th December 2015

Current status: Closed

Closed: Thursday 16th June 2016

Signatures: 42

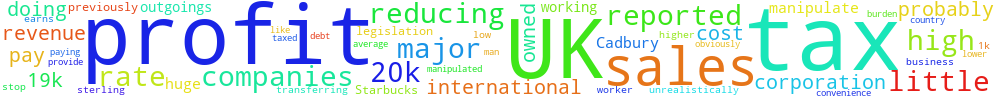

Tax major international companies on their UK sales, not their reported profit

Many major international companies manipulate the cost of doing business in the UK, transferring unrealistically high reported profits to a country of convenience where corporation tax is low. If the average UK worker earns 20k and has outgoings of 19k, he is still taxed on 20k, not his profit of 1k

How do companies like Cadbury (previously UK owned and paying tax), now pay little or no tax? How do US companies such as Starbucks pay little or no tax with huge sales and (probably) high profits. Reported profits can be manipulated and no legislation will stop this, but sterling sales are what they are. A sales tax rate will obviously be lower than the corporation tax rate but would provide higher tax revenue, reducing the burden on the working man and probably reducing our UK debt.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

13.58.136.190 Sat, 22 Feb 2025 22:22:07 +0000