Submitted on Monday 23rd May 2016

Published on Monday 23rd May 2016

Current status: Closed

Closed: Wednesday 23rd November 2016

Signatures: 54

Tagged with

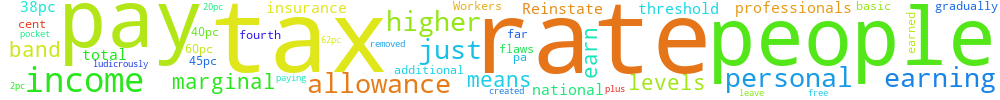

Reinstate the personal tax allowance for people earning over £100,000 pa.

Tax system flaws leave professionals paying 60 per cent tax, yet those on higher income pay just 45%.

Above the £10,600 tax-free personal allowance there are three bands of income tax people pay on earnings: 20pc (basic rate - from £10,600), 40pc (higher rate - from £42,385) and 45pc (additional rate - from £150,000).

But people earning over £100,000 gradually have their personal allowance removed at a rate of £1 for every £2 earned above the threshold, up to £121,200. This means a "fourth" band of "marginal tax" is created in which they pay 60pc on income in between these levels, plus 2pc for national insurance, a total rate of 62pc.

Workers pocket just 38pc of the income they earn between these levels. It means, ludicrously, that they pay a higher marginal tax rate than people who earn far more.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

18.119.109.229 Mon, 03 Mar 2025 20:09:52 +0000