Submitted on Monday 24th October 2011

Published on Thursday 15th December 2011

Current status: Closed

Closed: Saturday 15th December 2012

Signatures: 2

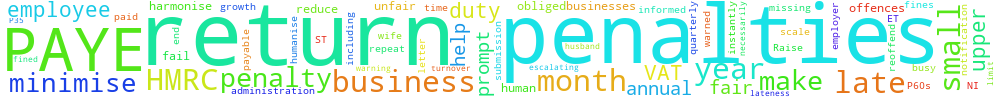

Small Business and HMRC: harmonise and humanise the system of penalties for late (or missing) returns - PAYE end of year return

The penalty for late submission of PAYE returns should be human as for VAT, first a warning letter, then up the scale for repeat offences (e.g. over the next 3 years). Raise the upper limit to £200,000 to help small business growth. HMRC should have a duty of prompt notification to minimise penalties, or be obliged to reduce penalties for THEIR lateness. *** If businesses with a turnover of less than £150,000 fail to make a quarterly VAT return on time they are warned. If they reoffend within a year they are put into an escalating system of penalties, not necessarily including fines. This is fair. *** If that small business makes its annual PAYE return (P35 and P60s) late, it is instantly fined £100 per month, even if all employees (e.g. husband and wife) are paid below the ET (ST 2011-2012) so no PAYE or NI is payable by employee or employer (to minimise administration) - and because "HMRC are so busy", not informed for months when the penalty is already £400 or £500. This is unfair.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

3.22.171.120 Mon, 24 Feb 2025 04:26:05 +0000