Submitted on Tuesday 6th December 2011

Published on Wednesday 7th December 2011

Current status: Closed

Closed: Wednesday 7th March 2012

Signatures: 237

Tagged with

5 years ~ HMRC ~ income tax ~ Tax

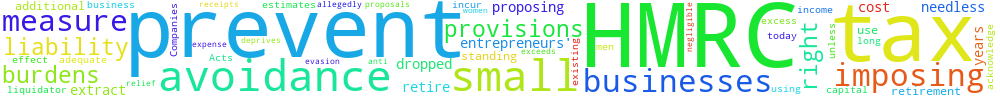

To Prevent HMRC imposing additional tax and cost burdens on very small businesses

Under proposals made today HMRC are proposing to prevent small businesses using long-standing provisions of the Companies Acts to extract their capital on retirement if it exceeds £25,000 and imposing an income tax liability on the excess unless they incur the needless expense of a liquidator which HMRC estimates at £7,500. This deprives small business men and women who retire of the right to use entrepreneurs' relief - the measure is allegedly to prevent avoidance/evasion (!) of liability but HMRC themselves acknowledge that it will have a negligible effect on tax receipts over the next 5 years. This measure should be dropped as existing anti-avoidance provisions are adequate to prevent avoidance.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

3.15.26.235 Sun, 23 Feb 2025 22:07:37 +0000