Submitted by Richard A F Hill on Thursday 26th March 2020

Published on Monday 11th May 2020

Current status: Closed

Closed: Wednesday 11th November 2020

Signatures: 11,390

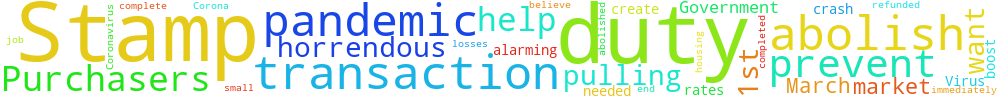

Abolish Stamp Duty on all transactions during Corona Virus pandemic

I want the Government to abolish stamp duty immediately until the end of the Coronavirus Pandemic!

I believe it will create a small well needed boost to the housing market and may help to prevent a complete crash. Stamp duty should be abolished for any transaction from March 1st 2020 and refunded if the transaction has already completed. Purchasers are pulling out at alarming rates and the job losses could be horrendous!

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

The Government responded to this petition on Tuesday 29th September 2020

To boost confidence in the property market, the Government temporarily cut SDLT. This means nearly 9/10 people getting on or moving up the property ladder pay no Stamp Duty at all.

The COVID-19 pandemic and subsequent lockdown caused uncertainty for those buying and selling residential property, resulting in a significant decrease in transactions. After this petition went live, the Government decided that the Chancellor of the Exchequer’s Summer Economic Update was the right time to introduce a temporary Stamp Duty Land Tax (SDLT) cut to encourage and maintain confidence in the property market. In turn, this will keep people in work, create jobs and support the wider economy.

This temporary cut increases the starting threshold of residential SDLT from £125,000 to £500,000 from the 8 July 2020 until 31 March 2021.

As is typical for many tax policy announcements made at fiscal events, the change to SDLT was effective from the day of announcement. Any changes to extend the relief retrospectively would inevitably lead to borderline cases for purchases completed at an earlier point. It is for this reason that the effective date for such changes is typically the day on which the announcement is made. The Government currently has no plans to back-date this change to 1st March.

This change will mean that nearly 90% people buying a main home outside of London will no longer pay Stamp Duty, with a maximum savings of £15,000.

SDLT continues to be an important source of government revenue, raising several billion pounds each year to help pay for the essential services the government provides. All tax policy is kept under review and the views expressed to us are considered carefully as part of that process.

HM Treasury

This is a revised response. The Petitions Committee requested a response which more directly addressed the request of the petition. You can find the original response towards the bottom of the petition page (https://petition.parliament.uk/petitions/310695)

18.118.7.113 Sat, 22 Feb 2025 17:30:13 +0000