Submitted on Friday 23rd March 2012

Published on Monday 26th March 2012

Current status: Closed

Closed: Tuesday 26th March 2013

Signatures: 9

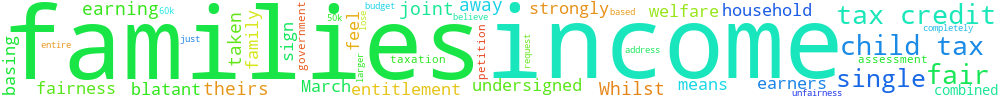

Fair child tax credit for single income families

Under the March 2012 budget, a family with joint income where both earners under £50k will keep their child tax credit in full. Whilst single income families earning over £60k will have theirs taken away.

This means some families will have a joint income of £98,000 and keep their child tax credit in full whilst other families earning £60,000 would lose theirs completely.

This just is not fair.

We the undersigned request the government address this blatant unfairness by basing the assessment of child tax credit entitlement on entire household income.

We believe it is not fair that families with a larger combined joint income will keep child tax credits when single income families earning less will have theirs taken away.

If you feel strongly that both taxation and welfare should be based on fairness please sign this e-petition.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

18.118.252.210 Wed, 26 Feb 2025 11:12:47 +0000