Submitted by Daljit Virdee on Wednesday 29th April 2020

Published on Wednesday 15th July 2020

Current status: Closed

Closed: Friday 15th January 2021

Signatures: 10

Relevant Departments

Tagged with

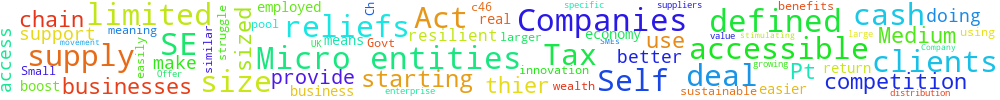

Access ~ Cash ~ Economy ~ innovation ~ Medium ~ movement ~ Size ~ Tax ~ UK economy

Tax reliefs for SMEs & larger Companies who use Micro-entities & SE as suppliers

Offer specific and easily accessible Tax reliefs to Companies which are defined as Small, Medium, or large, in return for them using Micro-entities and the Self-employed (SE) in thier supply chain.

(Company sizes as defined in the Companies Act 2006, c46, Pt 15, Ch 1.)

This will boost the UK economy & make it more resilient by stimulating the movement of cash.

Govt support on starting a business has made doing so easier. The real struggle is growing to a sustainable size, because Micro-entities & the SE mostly deal with similar sized businesses; meaning access to a very limited pool of cash. Micro entities can often provide much better value to clients, which means everyone benefits through competition & innovation and distribution of wealth via enterprise.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

3.144.46.105 Sat, 22 Feb 2025 09:50:38 +0000