Submitted by Ceres Brunning on Saturday 30th May 2020

Published on Thursday 6th August 2020

Current status: Closed

Closed: Saturday 6th February 2021

Signatures: 11,488

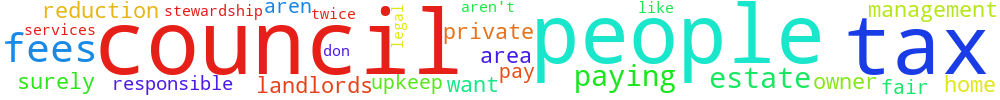

Council Tax reduction for people paying Estate Management fees

I want a reduction in Council tax for people on private estates paying stewardship/management fees.

I don’t see why people paying fees for estate management should pay full council tax like people who aren’t. Surely we are paying for some of the services twice? How is this fair or legal? If the council aren't responsible for the upkeep of the area then surely the home owner and the landlords in that area should get a reduction in council tax fees.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

The Government responded to this petition on Tuesday 13th October 2020

The Government has confirmed it will introduce legislation so homeowners can better challenge the reasonableness of estate management fees. However, there are no plans for a council tax discount.

Council tax provides a significant source of funding to enable local authorities to provide a very wide range of services to the community in their area. These include the delivery of adult social care, providing essential support to vulnerable individuals, children’s services, and waste management. It also contributes to the funding of police and fire services, securing the safety of residents in their communities. It has also helped authorities to continue to play a crucial role in funding the delivery of essential frontline services during the COVID-19 pandemic.

Where a new housing development takes place, developers and the local authority are responsible for putting in place any necessary agreements to provide funding arrangements to enable the ongoing maintenance of any common areas, shared structures or services that might be required as part of the development. Where the local authority agrees to adopt the facilities provided, they would generally do so on condition that sufficient funding is provided by the developer. Alternatively, developers might choose to make their own arrangements to ensure ongoing maintenance. Given these circumstances, the Government does not believe that it is appropriate to provide a specific council tax discount to reflect each individual case where maintenance is carried out by a management company.

More broadly, the Government provides a wide range of assistance with council tax bills. Further information on the ways that a council tax bill can be reduced can be found at: https://www.gov.uk/government/publications/paying-the-right-level-of-council-tax-a-plain-english-guide-to-council-tax.

However, the Government has announced its intention to bring forward legislation to give freehold homeowners on private and mixed tenure estates who pay estate management fees enhanced protections to challenge these charges if something goes wrong.

Developers of new private or mixed tenure estates may voluntarily provide open spaces for residents or be required, as a planning condition, to include public open spaces and make provision for its future upkeep. Developers and local planning authorities are responsible for agreeing appropriate funding arrangements for developments with common areas, shared structures or services. In all cases, the Government believes that it should be clear to potential purchasers what the arrangements are for the maintenance of roads and upkeep of open space, public or otherwise.

Where these costs do fall to homeowners, the existing arrangements to challenge such fees are limited. That is why the Government has announced its intention to legislate to give freeholders equivalent rights to leaseholders to challenge the reasonableness of estate rentcharges. This will include a right to apply to the First-tier Tribunal to appoint a new manager for the provision of services covered by estate rentcharges, and the proposals are set out at: https://www.gov.uk/government/consultations/implementing-reforms-to-the-leasehold-system.

Where a managing agent is employed, by law they are required to belong to either The Property Redress Scheme, or The Property Ombudsman. Complaints about charges or the standard or provision of services can be made to one of these redress schemes. The Government intends to legislate to extend mandatory membership of a redress scheme to freeholders or managing companies who manage communal spaces on private or mixed tenure estates, and who do not employ a managing agent. This will ensure that all relevant homeowners will be covered by a redress scheme.

The Government will also consider how homeowners on private estates could be supported to take on the management responsibility for common areas, shared structures or services should they wish to. We will consider introducing a Right to Manage for residential freeholders once we have considered the Law Commission’s report on changes to the Right to Manage for leaseholders, which can be accessed at: https://www.lawcom.gov.uk/project/right-to-manage.

The Government is committed to bringing forward leasehold legislation as soon as parliamentary time allows, recognising the impact that COVID-19 has had on the parliamentary agenda.

Ministry of Housing, Communities and Local Government

3.14.72.33 Sun, 23 Feb 2025 05:27:22 +0000