Submitted by Andrew Harrison on Thursday 25th June 2020

Published on Monday 7th September 2020

Current status: Closed

Closed: Sunday 7th March 2021

Signatures: 42,303

Relevant Departments

Tagged with

Careers ~ Extend ~ Football ~ furlough ~ furlough scheme ~ Jack ~ Live music ~ Opera ~ Pubs

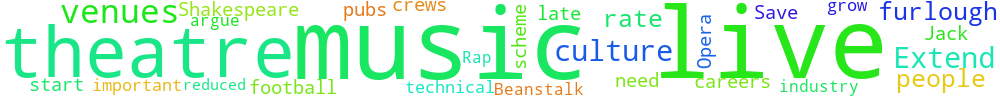

Extend furlough scheme for theatre and live music industry.

Extend the furlough, even at a reduced rate.

Save the technical crews before it’s to late.

Without theatres and live music venues where will your culture grow? We need theatre from Shakespeare to Jack in the Beanstalk. Live music venues start people’s careers & I argue that Rap to Opera are as important to our culture as football & pubs.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

The Government responded to this petition on Tuesday 27th October 2020

After 8 months, the CJRS will close on 31 October. The Chancellor has announced the Job Support Schemes to provide targeted support for businesses and employees.

The Government recognises the very challenging times facing the theatre and live music industry as a result of COVID-19. The sector is important to the UK economy, and that is why the Government has put in place a £1.57 billion package of targeted support for culture and the arts across the UK through the Culture Recovery Fund, over and above other measures to protect the economy from the effects of the pandemic.

Since 12 October, the Culture Recovery Fund has awarded a total of £409 million to 2,009 cultural organisations in England spanning arts, theatres, dance, orchestras, music venues and museums. This funding will help to enable performances to restart, protect jobs and create opportunities for freelancers. Further allocations will be announced in the coming weeks.

Theatre and live music companies have been able to use the Coronavirus Job Retention Scheme (CJRS) since its inception. The CJRS is specifically designed to protect jobs and support businesses threatened by the pandemic, across the whole country and across all sectors. The scheme has successfully protected over 9 million jobs to date.

However, the Government’s judgement has been that it would be extremely challenging to extend the CJRS for specific sectors in a fair and deliverable way, and that to do so would not be the most effective or sensible means by which to provide longer term support for those sectors most affected by COVID-19. It would also be difficult to target the CJRS at specific sectors without creating economic distortions, particularly since many firms work across multiple sectors.

To provide additional support to firms to keep employees as demand returns, the Government has announced the Job Retention Bonus, a one-off payment of £1000 to employers for each employee who has been furloughed, has been continuously employed until 31 January 2021 and is still employed by the same employer as of 31 January 2021.

The Government has further announced the Job Support Schemes (JSS) which will help UK employers retain their employees by helping to pay their employees’ wages. Businesses who can operate safely but are facing reduced demand will be able to access the JSS Open; businesses legally required to close their premises temporarily as a direct result of Coronavirus restrictions will be able to access the JSS Closed. Lowest paid employees who are on Universal Credit are likely to see an increase in the Universal Credit benefit to complement their JSS pay, thereby further limiting the reduction in their income.

Companies in the sector are also able to draw upon the wider package of measures announced by the Chancellor, including a Bank of England scheme for firms to raise capital, Time to Pay flexibilities with tax bills, financial support for employees and VAT deferrals. On 22 October, the Chancellor announced additional supports through retrospective grants for businesses in regions under tier 3 restrictions which are legally required to close, and businesses in regions under tier 2 restrictions which may not be closed but are operating at significantly reduced capacity.

These measures have been designed to ensure that firms of any size receive the help they need to get through this difficult time.

HM Treasury

3.22.27.192 Sat, 22 Feb 2025 12:37:40 +0000