Submitted by Lars Swann on Wednesday 6th January 2021

Published on Wednesday 13th January 2021

Current status: Closed

Closed: Tuesday 13th July 2021

Signatures: 33

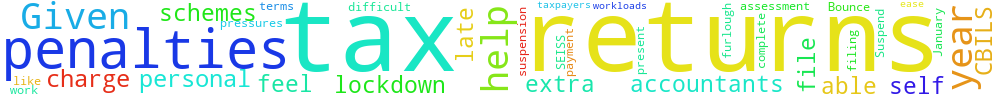

Suspend Penalties & interest charges on personal tax returns 2019/20 tax year.

We would like the suspension of filing penalties, late payment penalties and interest charge for personal self-assessment tax returns for the tax year 2019/20 only.

Given the present lockdown, it will be difficult for some taxpayers to be able to file their tax returns or get to see their accountants to help them complete this. We also feel that given the extra work that accountants have had to do in terms of furlough, SEISS, Bounce Back and CBILS schemes that this would help ease the pressures on their workloads this January.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

18.118.102.225 Mon, 06 May 2024 11:58:39 +0100