Submitted by Paul Treherne on Friday 28th April 2023

Published on Monday 5th June 2023

Current status: Closed

Closed: Tuesday 5th December 2023

Signatures: 66

Relevant Departments

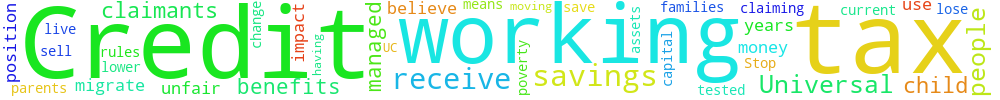

Keep working tax and child tax credits for working families

Stop change in moving over current working tax and child tax claimants to Universal Credit. Many working parents will receive lower or no benefits because of their savings.

If claimants have managed to save some money after years of claiming tax credits they may now lose their benefits when they migrate to Universal Credit due to rules about capital savings. Universal Credit is means tested, and savings can impact the amount you receive. This will put people into the position of having to use their savings to live or sell their assets before they can receive the full amount of UC, We believe this is unfair and might put people into poverty.

You can't sign this petition because it is now closed. But you can still comment on it here at Repetition.me!

18.217.241.79 Mon, 03 Mar 2025 19:41:51 +0000