Submitted on Friday 13th December 2024

Rejected on Friday 7th February 2025

Current status: Rejected

Rejection code: duplicate (see below for details)

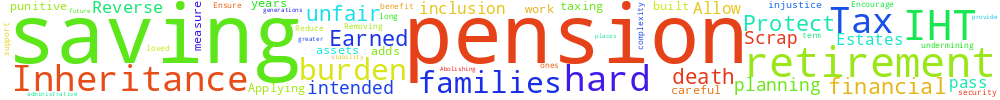

Scrap Inheritance Tax on Pensions to Protect Hard-Earned Retirement Savings

Reverse the inclusion of Pensions in Estates upon death. Allow families to pass on pension savings without the unfair burden of Inheritance Tax.

Inheritance Tax (IHT) is already a punitive measure, taxing assets that have been built through years of hard work and careful financial planning. Applying IHT to pensions adds further injustice, undermining retirement savings intended to support loved ones after death.

Removing IHT on pensions would:

• Ensure families can benefit from retirement savings as intended.

• Encourage long-term saving and financial security in retirement planning.

• Reduce the complexity and administrative burden of IHT.

IHT on pensions places an unfair burden on families. Abolishing it would protect hard-earned retirement savings and provide greater financial stability for future generations.

You can't sign this petition because it was rejected. But you can still comment on it here at Repetition.me!

The Government e-Petitions Team gave the following reason:

There's already a petition about this issue. We cannot accept a new petition when we already have one about a very similar issue.

You are more likely to get action on this issue if you sign and share a single petition.

You may wish to sign this petition which calls for the same action:

Do not change inheritance tax rules for pensions

petition.parliament.uk/petitions/700306

18.117.170.115 Tue, 25 Feb 2025 05:04:49 +0000